Artificial‑intelligence (AI) is no longer a peripheral technology or a novelty; it is rapidly becoming a foundational layer of business operations. From customer service chatbots to predictive analytics, AI has reshaped how companies operate. Yet the most transformative development may be the emergence of AI agents, autonomous digital actors that can perceive, reason, decide and act on behalf of a business. For leaders in insurance, third‑party administration, adjusting and managing general underwriting, AI agents represent both an opportunity for radical efficiency and a test of organizational readiness.

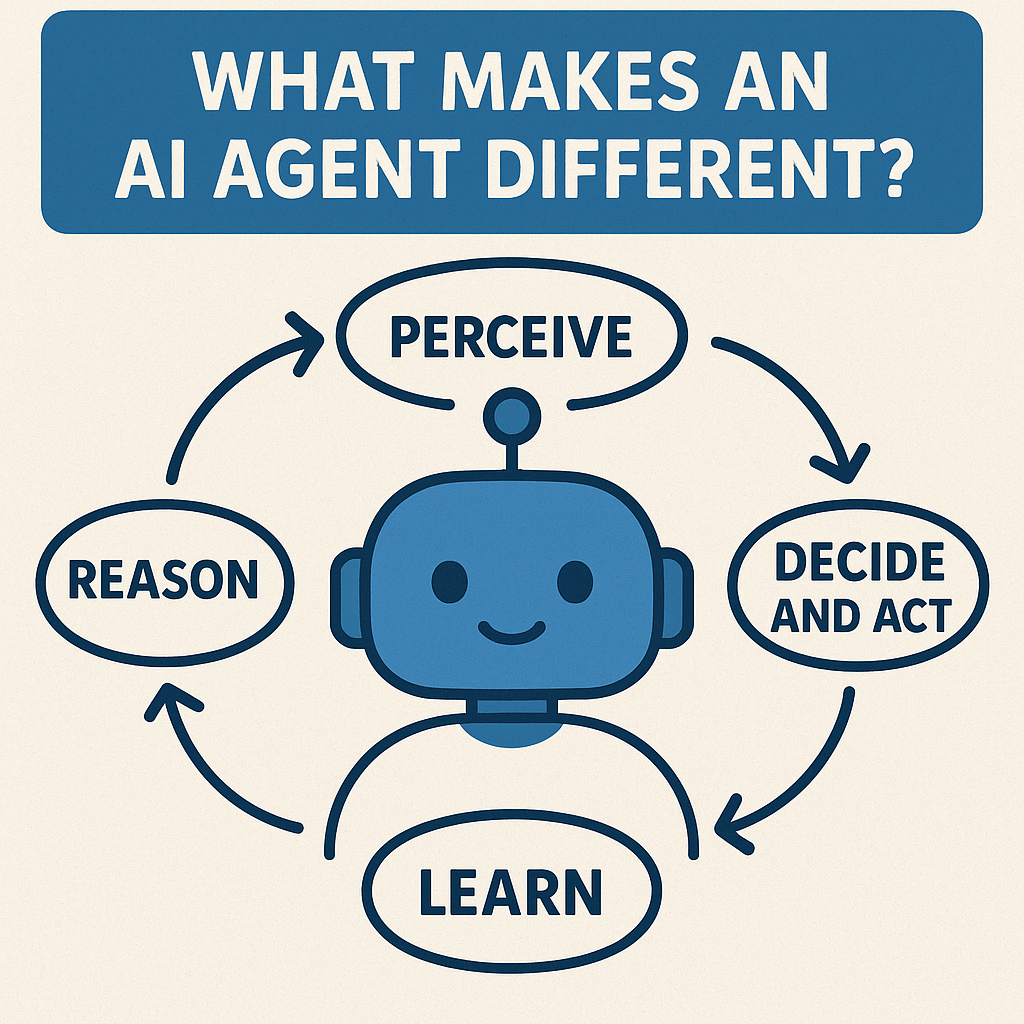

Traditional AI systems respond to explicit inputs: a predictive model forecasts loss ratios based on historical data, or a chatbot replies to a customer query. AI agents go further. They collect data from their environment, plan a sequence of actions, make decisions and execute those decisions autonomously. This closed-loop capability—perceive, reason, decide, act and learn, enables agents to manage complex workflows without constant human prompts. They can triage claims, analyze underwriting data, send alerts when anomalies arise and even collaborate with other agents.

IronHive.ai builds such agents to “work like your best team members, without the overhead.” The platform plugs into existing systems across finance, HR, operations and IT and automates routine workflows while surfacing insights. Agents monitor tasks, route exceptions for human approval, triage tickets, manage schedules and reduce manual data entry. For executives accustomed to siloed systems and repetitive processes, this represents a step change in efficiency.

Headlines often warn of an AI‑driven job apocalypse. The McKinsey Global Institute estimated that automation could displace 400–800 million workers worldwide by 2030. At the same time, the World Economic Forum projected that while 85 million jobs may be displaced by 2025, 97 million new roles will be created. Venture capitalist Vinod Khosla recently predicted that AI will be able to do 80 % of the work in 80 % of jobs within five years, heralding a faster demise of Fortune 500 incumbents. Yet the same Fortune 500 companies are embracing AI: by August 2023, over 80 % of Fortune 500 firms had integrated ChatGPT into their workflows.

For insurance and related sectors, these statistics signal neither inevitable obsolescence nor unchecked automation. They underscore the need for a strategic response: adopting AI agents to handle repetitive tasks while reskilling employees for higher‑value work. IronHive’s approach acknowledges this duality by integrating a business culture coach into deployments. As part of each project, IronHive collaborates with client leadership to assess organizational culture, identify potential resistance and tailor change management strategies. By bringing human‑centric coaching into the process, IronHive helps clients maintain their culture and values even as technology reshapes workflows.

Insurance is a data‑rich, regulation‑heavy industry that still relies on labor‑intensive processes. Agentic AI offers advantages across the insurance value chain:

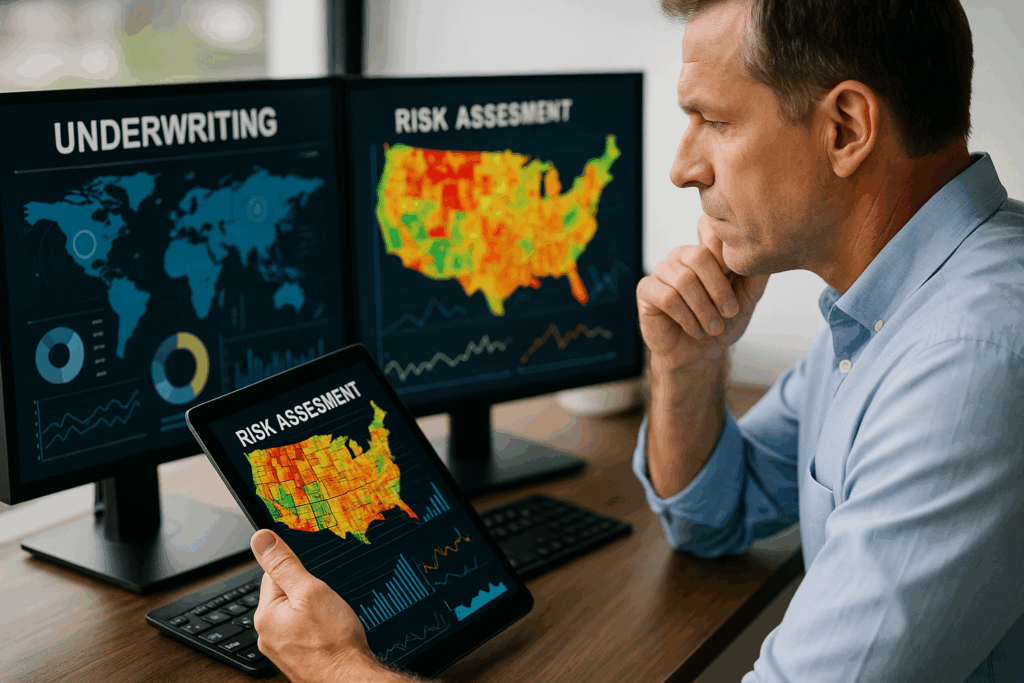

Agentic AI ingest telematics, social media, behavioral data and real‑time market information to refine risk models. Underwriters can generate personalized policies on demand, reducing lead times and improving competitive pricing.

Continuous data streams allow AI agents to adjust rates dynamically. Traditional rating cycles can take months; agentic AI makes pricing responsive to emerging risks without sacrificing compliance.

AI agents verify documents, assess damage and determine liability. Case studies show that agentic AI reduces claims resolution time by up to 60 %. For TPAs managing high volumes of claims, this translates into lower operating costs and better client service.

Pattern recognition and anomaly detection allow AI agents to flag suspicious claims early. A McKinsey estimate notes that AI‑based fraud detection can reduce false claims by up to 80 %, protecting carriers’ loss ratios and keeping premiums stable.

IronHive’s agents automatically check documents and emails for regulatory violations, track vendor risk and log all actions for audit trails. For MGUs and MGAs operating under multiple jurisdictions, such automation reduces regulatory exposure and streamlines reporting.

Customers expect personalized service; 71 % of insurance customers want tailored interactions but only 31 % feel they receive them. AI agents provide multilingual support, guide claims navigation and personalize outreach, freeing human agents to focus on complex cases.

Beyond client-facing tasks, AI agents automate back‑office functions. They handle accounts payable/receivable, HR onboarding, compliance checks, IT ticket triage and knowledge management. In adjusting firms, this reduces administrative overhead and speeds up decision-making.

While many vendors offer AI modules, IronHive.ai stands out by coupling agentic AI with digital twin technology and smart camera monitoring. The platform builds real‑time digital replicas of physical assets, buildings, equipment, even entire facilities. These living models ingest sensor data, building information models and maintenance logs to provide a 360‑degree view of asset health, risk and performance. For insurers, this means proactive risk mitigation and enhanced underwriting. For facility managers, it means predictive maintenance and lower operating costs.

IronHive’s camera-monitoring solution adds another layer of value: intelligent gun detection, perimeter monitoring and anomaly detection. When paired with digital twins, these cameras feed contextual data back into the system, enabling rapid threat identification and coordinated responses. Such integrated monitoring is particularly relevant for high‑risk industries or properties.

Finally, IronHive emphasizes cost sensitivity. The company acknowledges that AI transformation can be resource-intensive, so it offers scalable deployment models. Clients can start with a single process (e.g., claims triage) and expand as ROI is realized. By leveraging existing systems and focusing on targeted automation first, IronHive lowers the barrier to entry.

The advent of agentic AI raises important questions: How do we ensure fairness? How do we protect data? How do we support employees through change? IronHive’s implementation methodology addresses these issues. The company embeds ethical governance by designing agents to operate within defined boundaries and provides human oversight to prevent unintended consequences. It offers robust encryption and access controls to safeguard sensitive information. Most importantly, IronHive brings in a business culture coach to help teams adapt. This coach works alongside client leaders to align AI initiatives with organizational values, encourage open communication and develop reskilling pathways.

IronHive.ai embodies this philosophy. By integrating AI agents with digital twins and intelligent monitoring, offering change‑management support and focusing on ROI, IronHive provides a holistic solution for organizations navigating the agentic era. Executives considering AI initiatives should see this as a blueprint: combine cutting-edge technology with cultural stewardship to unlock productivity, resilience and trust.

Ready to explore AI agents tailored to your organization?

Visit IronHive.ai to learn more or schedule a demo.

© IronHive.AI, All Rights Reserved.